What does DODD FRANKIE MEAN TO ME?? Yes this involves housing and cars

admin

What does DODD FRANKIE MEAN TO ME?? Yes this involves housing and cars

With the huge changes in the election, many of our customers and businesses that will be using us in the future for transactions are starting to ask questions about capital, trade, and what that means to the market. If our government doesn't piss any other countries off we maybe moving into Bonanza territory because the anchor has just been lifted off of the banks. Back in early 2008 when the U.S. had an unprecedented meltdown there was a change to the narrative played in earlier times of easy money, sign the approval and get what you need see the changes to Dodd-Frank forced the banks to be more systematic venting of someone's credit score. "Well Make a America great again" is making a change and we may see the kryptonite cape knocked off of all the big banks where they can lend without fear of the repercussions of losing. Hold on now what did the recovery do for us, the one we came out that linked our pains to that of 1929.

Let's see what we can decipher from the numbers (all numbers provided by FRED):

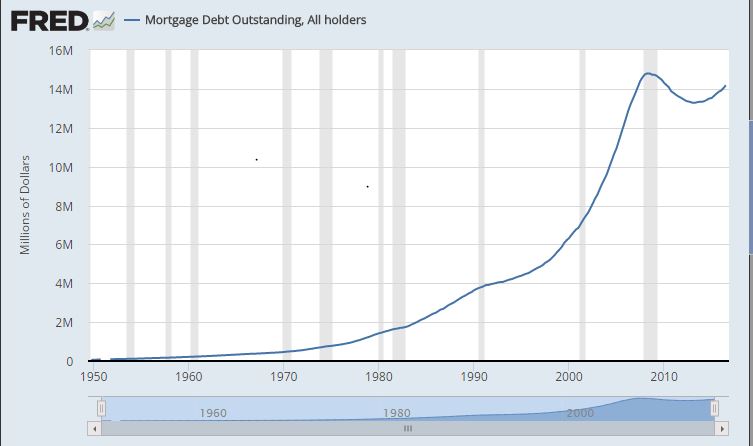

Mortgage debt chart as you can see we are rising to levels right before we saw the big bubble of 2008:

What does this mean? We are buying houses again. Is there another bubble or are we rising to levels at a more a steady pace which allowed for the market to absorb the climb in a more natural manner. What about el carro, what can we say about the auto loan market. Well, on one hand, it has risen expediently. When a loan is approved that also means that there are people employed and with enough of a ratio of dollars to debt to be able to afford such an expenditure.

Now we look at some charts that are able to back up these statements telling us whether we may be seeing a rise in defaults due to not being able to meet your mortgage bill or your car note:

So the one area that should tell us if we have money to spend is how much money that has been saved. Take a look at the numbers, the one area that may give us a bit of pause is with regards to the personal savings ratio to percent of income but it has been steady around the 5% percent range for over a decade.

Looks like our banks are steady as well. From the numbers, if accurate we may be headed into the biggest bull market in history or possibly the greatest flash recovery. I am not a betting man but I think were at the beginning of something.

For interests in US Housing, or Exotic Automobiles please send an email to sales@macheene.com