Money Money $$$$ Money $$: I don't know about buying a Home well than what about renting, it looks better than stocks

admin

Money Money $$$$ Money $$: RENTING

So let's be honest things are a bit peachier but also a bit bubblier. By that I mean there is some fear that the market needs to correct itself and this happens every 7 to 10 years based on history. So where is the love at now, how can you get in and make a profit even if the market goes down..Well, I am not an advisor but there is also another way to make money when purchasing the property because when it comes to living there is to option Rent or Buy and some rental markets are just heating up. So what happens when the market goes down, does my rental price go down that depends on supply and demand market correction doesn't always mean foreclosure. Let's take a look at the top cities in the world for what I call double digit appreciation:

If stocks average just 8% than the rental market must be an island next to Jupiter as some places are seeing 62% growth according to Realty Trac data:

Let me preempt the warning if you think you're going to see high-end areas like Los Angeles, New York, Toronto, Paris, or Milan your wrong. These opportunities come in the places that are usually hit the hardest with the lowest price entry point and the high potential for new growth

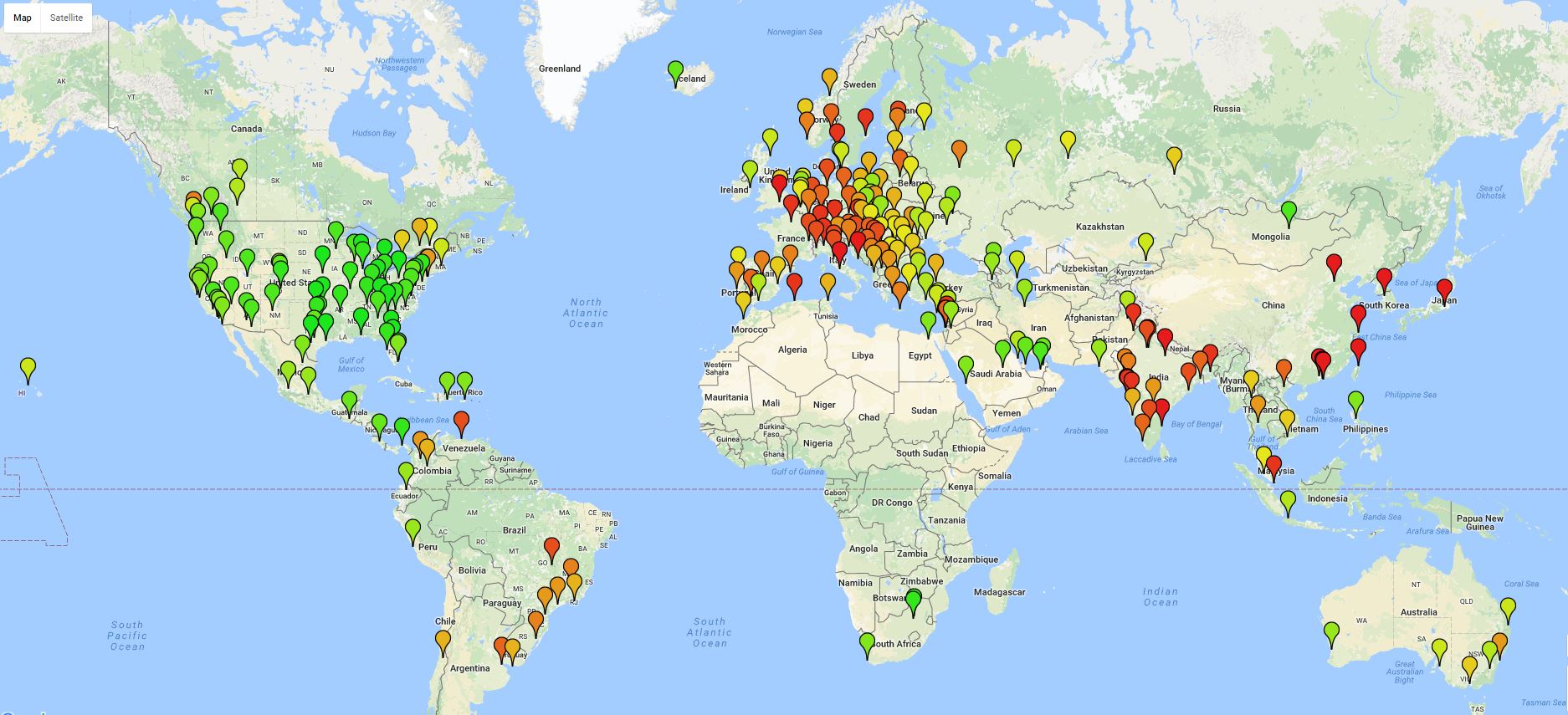

2016 Rental Market (Realty Track Map)- These are high's

Just for kicks what do your beloved cities see for SFR returns:

Enough Said, look for markets that have been depressed and are on the incline, these bring measurable amounts of dollars back into the income stream. Yes, Rentals can reap benefits now watch the costs of the repairs this can come back to eat away at your net profits.

So let's be honest things are a bit peachier but also a bit bubblier. By that I mean there is some fear that the market needs to correct itself and this happens every 7 to 10 years based on history. So where is the love at now, how can you get in and make a profit even if the market goes down..Well, I am not an advisor but there is also another way to make money when purchasing the property because when it comes to living there is to option Rent or Buy and some rental markets are just heating up. So what happens when the market goes down, does my rental price go down that depends on supply and demand market correction doesn't always mean foreclosure. Let's take a look at the top cities in the world for what I call double digit appreciation:

If stocks average just 8% than the rental market must be an island next to Jupiter as some places are seeing 62% growth according to Realty Trac data:

Let me preempt the warning if you think you're going to see high-end areas like Los Angeles, New York, Toronto, Paris, or Milan your wrong. These opportunities come in the places that are usually hit the hardest with the lowest price entry point and the high potential for new growth

2016 Rental Market (Realty Track Map)- These are high's

- Midwest, USA Crowd - Read this and Weep (WOW)

- Flint, MI - 150% Return

- Louisville, KY - 81% Return

- Peora, IL - 76% Return

- Pittsburg, PA - 72.5% Return

- Cleveland, OH -63.5% Return

- South, USA - Hold on and brace yourself New York your not on top of everything

- Jefferson, AL - 89% Return

- Jacksonville, GA - 62% Return

- Little Rock, AR - 62.1 % Return

- Macon, GA - 58.4 % Return

- Want to see how the world stacks up

- Panama - 9%

- Jordan - 10.46%

- Colombia - 9.6%

- Moldova - 13%

Just for kicks what do your beloved cities see for SFR returns:

- London - 6%

- New York - 9%

- Miami - 11%

- Shanghai - 10%

- Rome - 3%

Enough Said, look for markets that have been depressed and are on the incline, these bring measurable amounts of dollars back into the income stream. Yes, Rentals can reap benefits now watch the costs of the repairs this can come back to eat away at your net profits.