Housing Market Prices are rising, What does that mean for me??

admin

Interest Rates Rise, What does that mean for me??

How far we have come, how long of a bull run it's been and now we are at this point about equal to where we drowned back in 2008-2009 but the dynamics are different. So your back up on your fight and looking at the options and in some heated markets such as Miami, New York City, San Francisco, even Austin, Texas your wondering can this cycle continue. Let's focus on the markets that Macheene was born from Florida and the questions on the dynamics that help shape or form a decision in a market whether it be the local, or niche players who will lead the growth. Yes, walk a tightrope this could go higher or could turn down downward.

Let's take a look at the most popular category of buying which for most of the land (sorry Miami and New York) is single-family homes. In Florida the current state of affairs for growth, please close your eyes and don't take deep breathe's is the following, remember the key factors that played a role in these prices back in 2015 and what is happening now:

2015 Scenario's

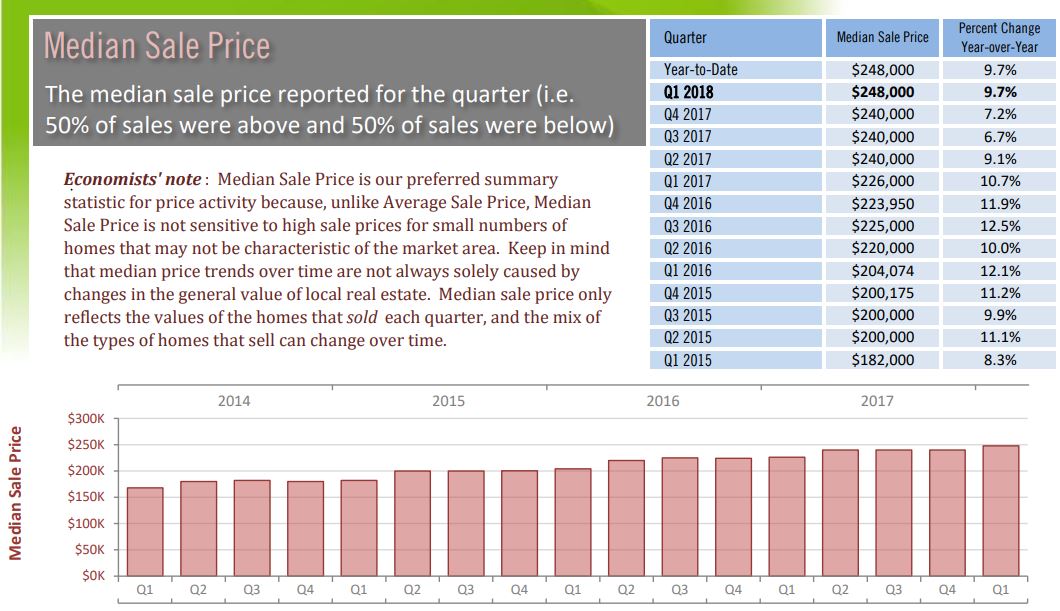

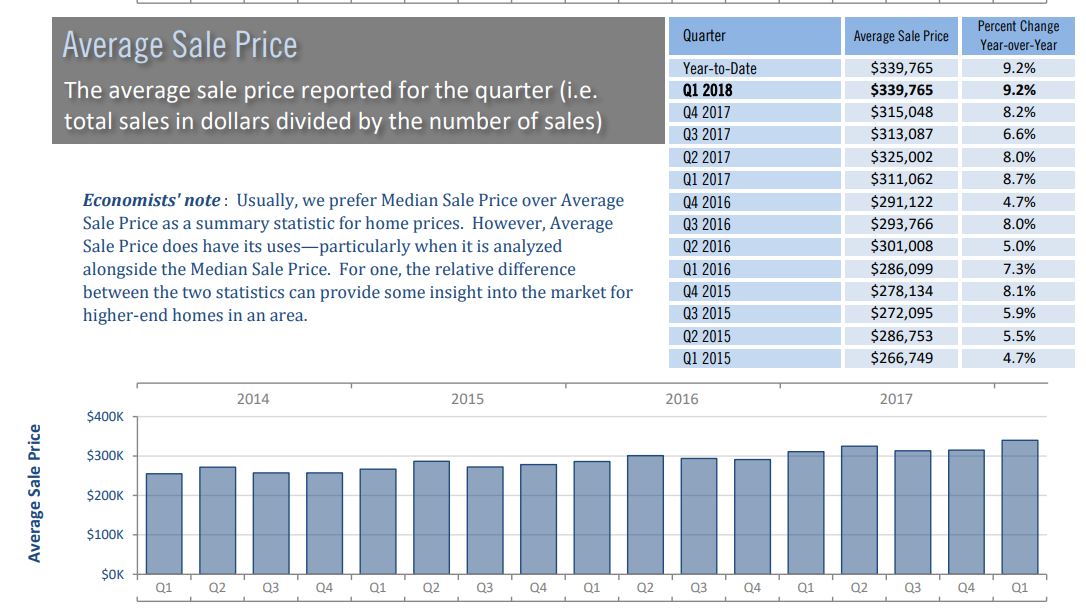

PRICES ARE RISING ....

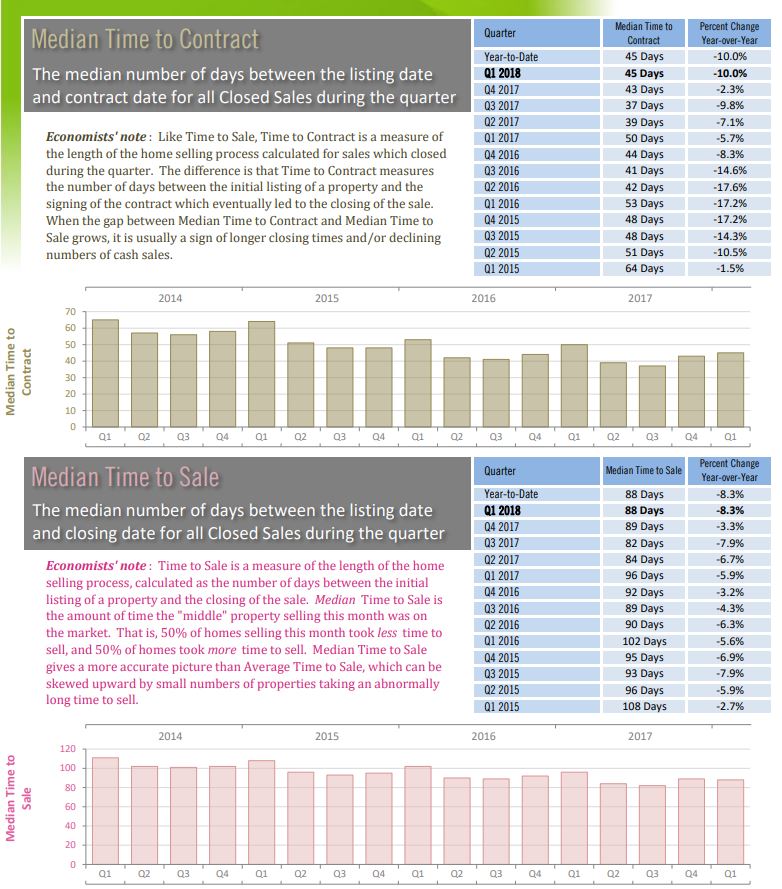

TURN AROUND TIME TO BUY IT HAS DECREASED:

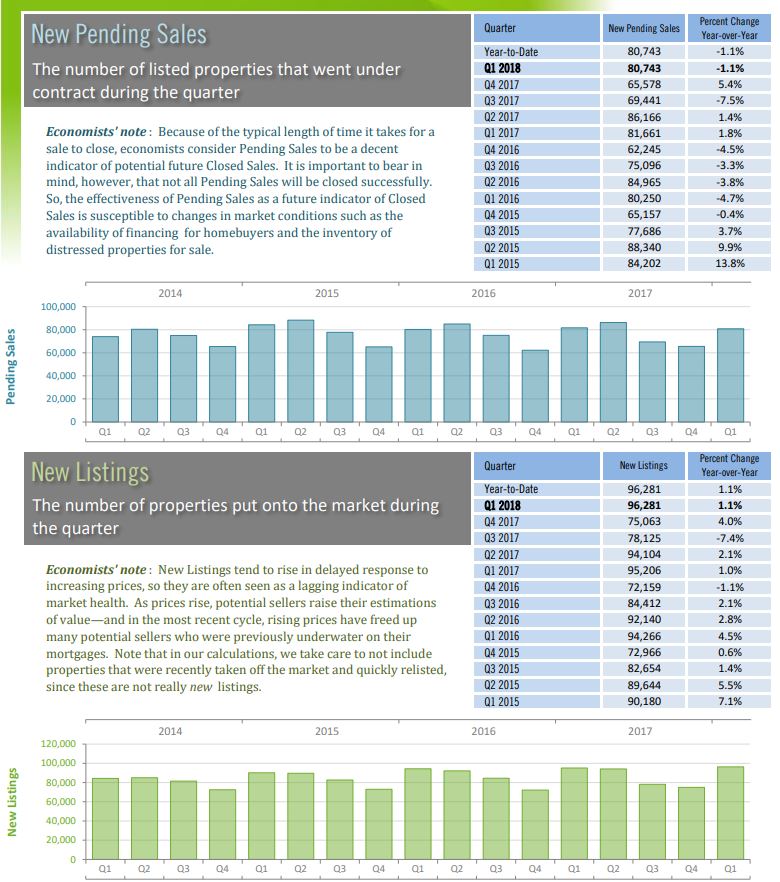

SALES ARE UP - YES SIR / SO ARE NEW LISTINGs - This could slow down the market in the future possible cool down for the housing prices.

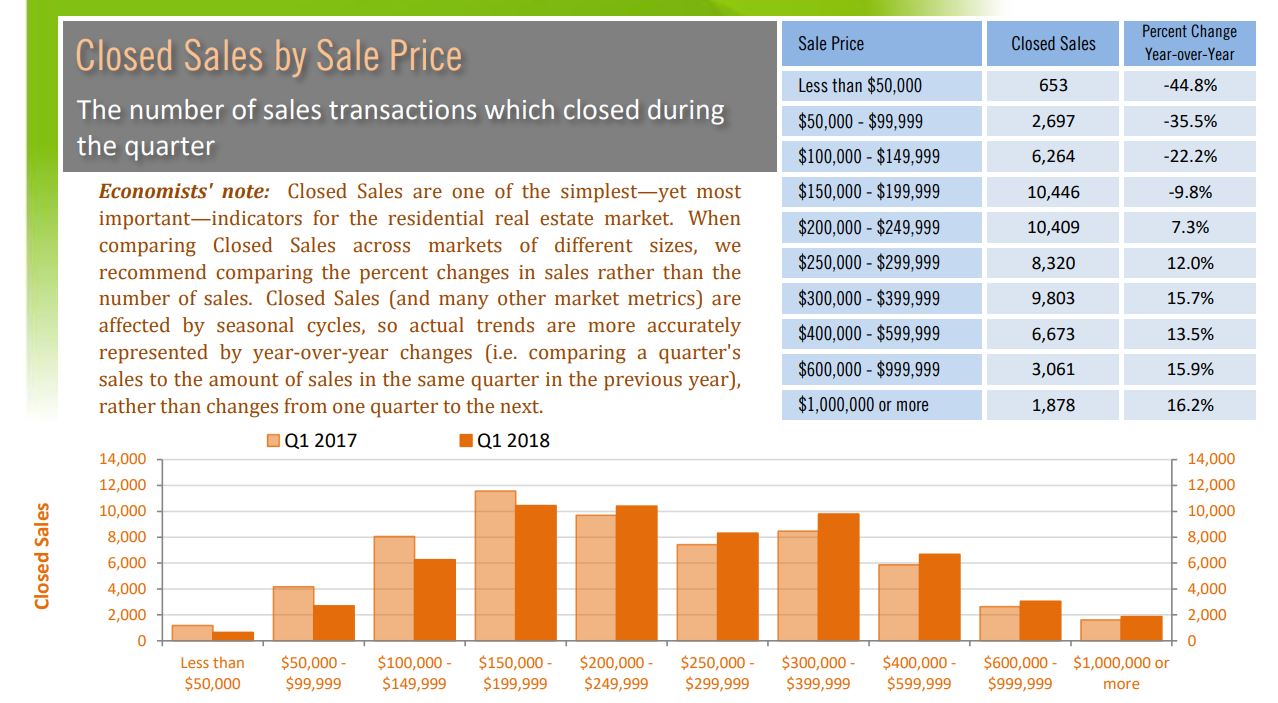

Take a look at the price ranges it's still that midpocket that supports the middle class that has the biggest amount of sales. With tax incentives focused on homes 500k and lower look to continue seeing this growth for these pockets.

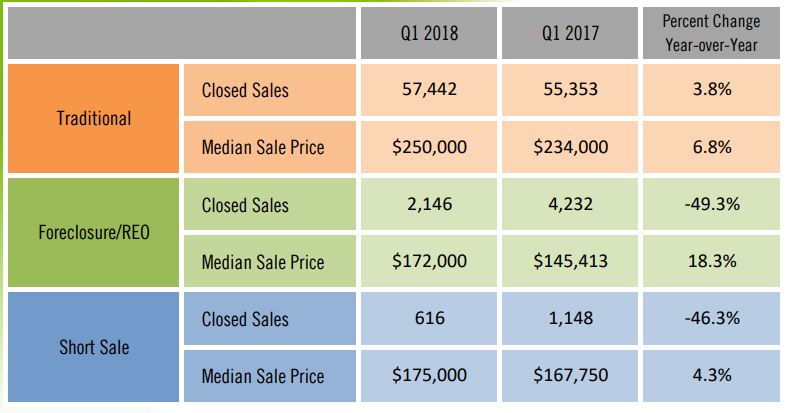

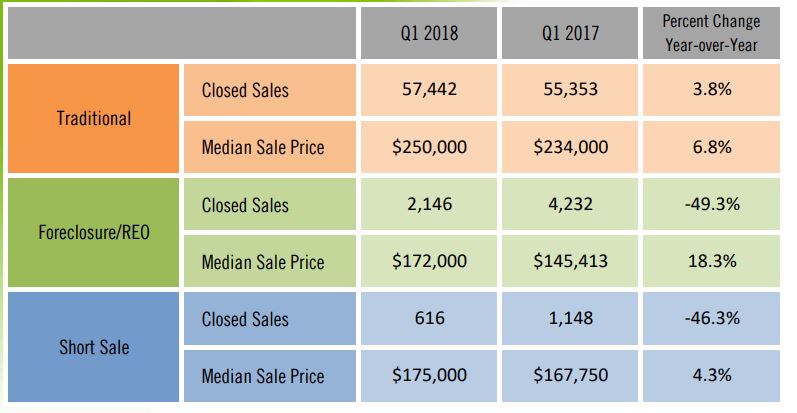

Investor be aware of a big decrease in Foreclosure and Short Sale Activity

The Aha moment hasn't come but the uncertainty on what to do has risen let's look at the strongest player will endure theory without looking at old highlights of Michael Jordan or Larry Bird. See even when the market collapsed back in 2009 there were some markets that didn't have the same type of meltdown that was found in some already hit markets like Detroit and Las Vegas. Namely New York City see as a PERCENTAGE remember the operative word after 2009 the prices merely went down 10-15% nothing like the 50-60% discounts you saw in good old Detroit and Miami. Take a peak of this excerpt from an old article:

What does New York have on its side yea...i know it obvious so I have to restate like its unknown. JOBS, ATTRACTIONS, JOBS, and more affluent influence than almost any major city in the world. So that's all that kept it up, the point if you keep on getting paid and there is a little time square charm in your area stay in it not much movement in downturns unless apocalypse has come. So how do you look for these, check your social media where are people constantly visiting if you in invests in the surrounding areas you are sure to be a winner. Does this mean you will always be a winner, I hate to say follow the money you have less likely a chance to feel the hit as most of the homes are close to be paid off or have been paid off so they don't suffer from the same foreclosure pressures as let's say a more Blue Collar city.

Back in 2010 screenshot

I hope this wasn't redundant probably is and will be. Interests rates are rising will be the next article to summary will show you how over the long term higher interest rates mean lower home prices but actual more costs if you don't pay the thing off in 30 years.

How far we have come, how long of a bull run it's been and now we are at this point about equal to where we drowned back in 2008-2009 but the dynamics are different. So your back up on your fight and looking at the options and in some heated markets such as Miami, New York City, San Francisco, even Austin, Texas your wondering can this cycle continue. Let's focus on the markets that Macheene was born from Florida and the questions on the dynamics that help shape or form a decision in a market whether it be the local, or niche players who will lead the growth. Yes, walk a tightrope this could go higher or could turn down downward.

Let's take a look at the most popular category of buying which for most of the land (sorry Miami and New York) is single-family homes. In Florida the current state of affairs for growth, please close your eyes and don't take deep breathe's is the following, remember the key factors that played a role in these prices back in 2015 and what is happening now:

2015 Scenario's

- Low Wage Earnings

- Job Growth Was just tethering up

- Largest Housing collapse in a Decade

- No Confidence in government

- QE landed but it takes time to implement the spending

- Wage Growth

- Job Growth

- Housing Confidence

- QE has landed and is taking form

- Government Business focus, tax cuts

- Interest rates are rising (Hurry hurry get it before it's gone mentality)

PRICES ARE RISING ....

TURN AROUND TIME TO BUY IT HAS DECREASED:

SALES ARE UP - YES SIR / SO ARE NEW LISTINGs - This could slow down the market in the future possible cool down for the housing prices.

Take a look at the price ranges it's still that midpocket that supports the middle class that has the biggest amount of sales. With tax incentives focused on homes 500k and lower look to continue seeing this growth for these pockets.

Investor be aware of a big decrease in Foreclosure and Short Sale Activity

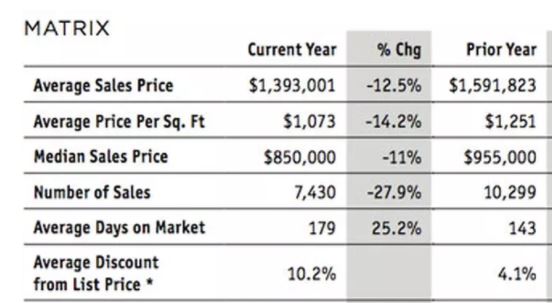

The Aha moment hasn't come but the uncertainty on what to do has risen let's look at the strongest player will endure theory without looking at old highlights of Michael Jordan or Larry Bird. See even when the market collapsed back in 2009 there were some markets that didn't have the same type of meltdown that was found in some already hit markets like Detroit and Las Vegas. Namely New York City see as a PERCENTAGE remember the operative word after 2009 the prices merely went down 10-15% nothing like the 50-60% discounts you saw in good old Detroit and Miami. Take a peak of this excerpt from an old article:

What does New York have on its side yea...i know it obvious so I have to restate like its unknown. JOBS, ATTRACTIONS, JOBS, and more affluent influence than almost any major city in the world. So that's all that kept it up, the point if you keep on getting paid and there is a little time square charm in your area stay in it not much movement in downturns unless apocalypse has come. So how do you look for these, check your social media where are people constantly visiting if you in invests in the surrounding areas you are sure to be a winner. Does this mean you will always be a winner, I hate to say follow the money you have less likely a chance to feel the hit as most of the homes are close to be paid off or have been paid off so they don't suffer from the same foreclosure pressures as let's say a more Blue Collar city.

Back in 2010 screenshot

I hope this wasn't redundant probably is and will be. Interests rates are rising will be the next article to summary will show you how over the long term higher interest rates mean lower home prices but actual more costs if you don't pay the thing off in 30 years.